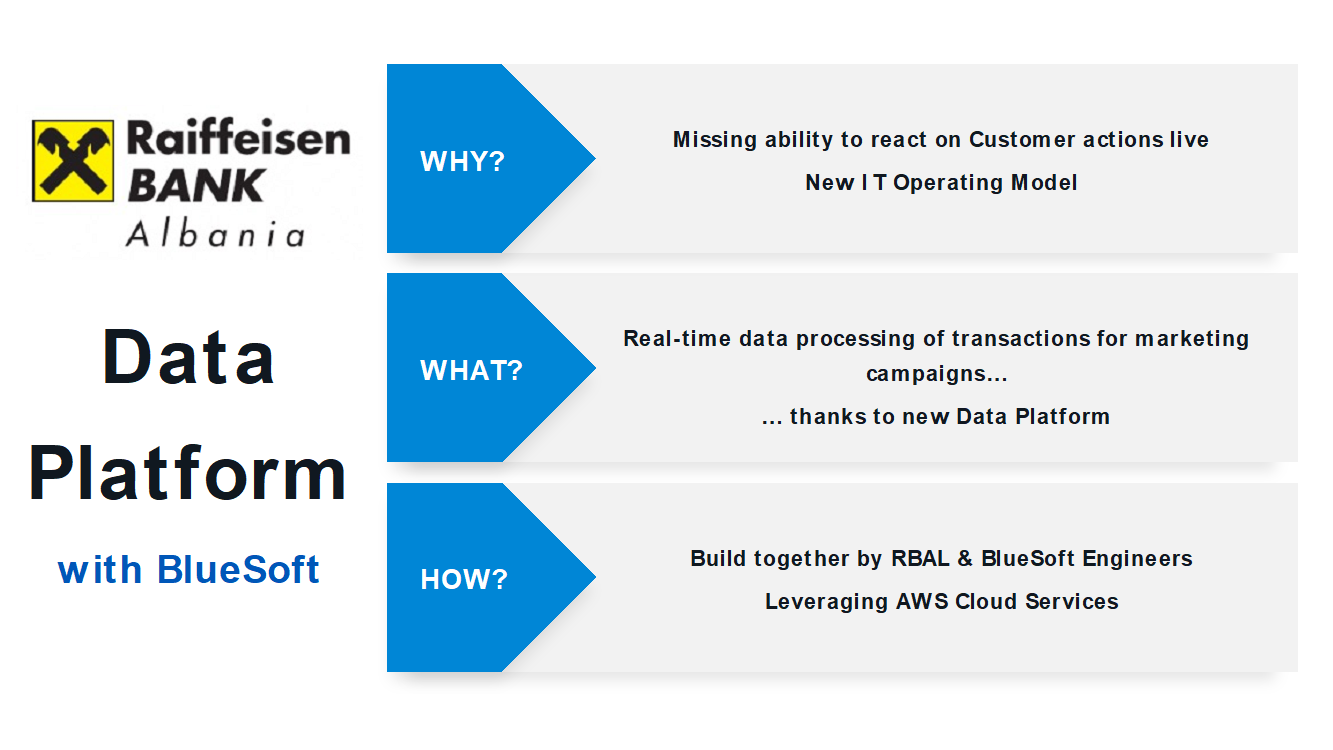

The Customer Challenge

The CRM Department at RBAL had a specific requirement for real-time processing of selected data from multiple business domains and systems, aimed at creating targeted campaigns. One such campaign involved notifying customers, immediately after making a withdrawal at an ATM, about the nearest locations where cashless payments were accepted, thereby promoting the use of cards as an alternative to cash. The success of this campaign relied on processing the ATM transaction data swiftly to ensure customers received timely notifications about relevant events, rather than receiving information about transactions that occurred hours or even days ago, which would likely be forgotten. However, the existing standard data transitions at RBAL primarily operated through batch processing on scheduled after working hours, mostly during the night. To address this limitation, RBAL recognized the need to implement a new real-time solution that would enable immediate data flows between transaction systems, CRM and customer facing system. It was crucial for this solution to align with the target Operating Model, offering flexibility from both technical and management perspectives.

Solution

In collaboration with RBAL Engineers, we have established a dedicated Data Platform Team with the objective of creating a robust solution for real-time data processing between systems. Instead of being a bottleneck responsible for implementing all data flows within the bank, the team adopted the principles of Platform Engineering for Data. Their focus was on creating an environment where other teams could easily develop the necessary data flows.

Working closely with CRM and Transactions Systems Engineers, the Data Platform Team successfully designed and implemented a Data Platform that facilitated real-time data flow for marketing campaigns.

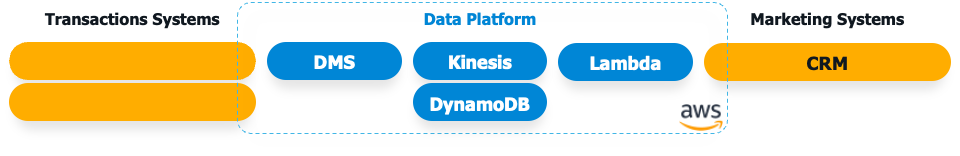

The solution heavily relies on various AWS services, including DMS (Database Migration Service), DynamoDB, Lambda, and most notably, Kinesis. These services played a crucial role in the described system’s architecture and functionality. The data processing workflow can be divided into the following stages:

- Data Retrieval and Update: The DMS retrieves data from one of the bank’s systems and pushes it to DynamoDB for periodic updates in the lookup tables stored within the database. Simultaneously, Kinesis Data Streams captures real-time transaction data from ATMs located across the country.

- Data Enrichment: Kinesis Data Analytics enriches the transaction data by adding additional context, such as customer information, account details, card data, etc., obtained from DynamoDB. The enriched information is then prepared for further processing.

- Data Consumption: The consumer of this data, in this specific case, is the CRM system. It obtains the enriched information from the Lambda service, which writes the data directly into the appropriate tables within the CRM system for further utilization.

Through the collaborative efforts of the Data Platform Team, CRM Engineers, and Transactions Systems Engineers, this solution enables RBAL to achieve efficient real-time data processing and supports the seamless execution of targeted marketing campaigns.

Results and Benefits

The initiative has yielded three significant benefits for the bank:

- Utilizing Real-time Data for Direct Marketing Campaigns:

By implementing the Data Platform and enabling real-time data processing of ATM transactions, the bank has gained the ability to leverage this valuable information for direct marketing campaigns. The timely insights obtained from real-time data allow the bank to create targeted and personalized marketing initiatives, maximizing their effectiveness in promoting various products and services.

- Validation of the Data Platform Team’s Operating Model:

The establishment of the Data Platform Team provided an opportunity for RBAL to validate their chosen operating model. Through the successful implementation and operation of the Data Platform, the bank has confirmed the effectiveness and efficiency of the team’s approach to data processing. This validation strengthens the bank’s confidence in the team’s capabilities and sets a precedent for future endeavors within the organization.

- Expansion of Offerings to End Customers:

The newly acquired capabilities for processing real-time events and data present an opportunity for the bank to extend its offerings to end customers. By leveraging the insights gained from real-time data processing, RBAL can develop and deliver innovative services and solutions that cater to evolving customer needs. This expansion allows the bank to enhance customer experiences, provide more tailored offerings, and remain competitive in the market.

Overall, the initiative has empowered the bank to harness the potential of real-time data, optimize their operational model, and introduce new customer-centric offerings, thereby driving growth and enhancing the bank’s position in the financial industry.

Partnership with BlueSoft

RBAL’s decision to partner with BlueSoft was driven by several key factors, establishing a fruitful collaboration between the two organizations:

- IT Acceleration Program and Modernization: The partnership between RBAL and BlueSoft began in 2019 as part of an IT Acceleration Program aimed at modernizing RBAL’s IT portfolio, including both architecture and technology. The program’s objective went beyond technical aspects and emphasized transforming the collaboration between the business and IT departments. BlueSoft was chosen as a partner to support RBAL in developing strategic programs related to transformation and introducing a new Operating Model. Their expertise in Team Topologies and Platform Engineering patterns played a crucial role in enabling RBAL to drive successful changes within the organization.

- Successful Collaboration with Raiffeisen Group: BlueSoft’s collaboration with RBAL was strengthened by their established partnership with Raiffeisen Group since 2015. BlueSoft had already implemented a range of initiatives that contributed to achieving strategic goals at both the group level and network banks in countries such as Poland, Croatia, Albania, and Ukraine. This demonstrated track record of successful collaboration and delivering results within the Raiffeisen Group made BlueSoft a trusted and reliable partner for RBAL.

By partnering with BlueSoft, RBAL leveraged their expertise and experience in technology, transformation, and strategic implementation. This collaboration allowed RBAL to accelerate their IT modernization efforts, adopt new operating models, and successfully execute their transformation initiatives, ultimately driving positive outcomes for the organization.